Workshop: Lawn Maintenance Best Practices

Your lawn can be the envy of the neighborhood! Learn how to select the best grass for your lawn …

Please email or call ahead for assistance. We look forward to hearing from you about your needs and concerns in Carteret County.

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

Collapse ▲

Your lawn can be the envy of the neighborhood! Learn how to select the best grass for your lawn …

For 2 pesticide credit hours, attend the N.C.Cooperative Extension, Onslow County Center training on Onslow Pro Day, taught by N.C. State …

Carteret County 4-H News and Upcoming Opportunities Each month, Carteret County 4-H shares a newsletter of upcoming activities and opportunities. …

Carteret County 4-H News and Upcoming Opportunities Each month, Carteret County 4-H shares a newsletter of upcoming activities and opportunities. …

The links below will provide our field crops newsletters, Agricultural Updates, converted to a pdf format. Please realize that …

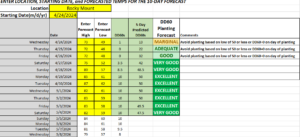

Based on the weather forecast right now for multiple areas across the state, it appears that we’ll have a …

Keith Edmisten and Guy Collins Extension Cotton Specialists, NC State University We are seeing a warming spell predicted after a couple …

Highly pathogenic avian influenza (HPAI) has moved from poultry to cattle and, in at least one confirmed case, a human …

Interest in the use of unmanned aerial vehicles (UAVs), or drones as they are more commonly known, for pesticide …

With planters rolling soon, we urge growers to think about thrips management now. The best source of information for …

Pruning tools are the implements to sharpen for trees, shrubs and flowers. It may not take much effort to …

Tools we use in vegetable gardens like shovels, hand trowels, and hoes can also use a good sharpening before …

It’s a little-known fact that most people don’t sharpen their lawn mower blades nearly often enough. One of the …

Beans Gone Wild is an interactive online tool that catalogs arising soybean issues across North Carolina annually. The issues …

Check out the new article from NC State University news, It’s a Wolfpack World, featuring NC 4-H Camps. “Camp has this magical …

This spring, staff from North Carolina’s 4-H Camps joined the CBS 17 program, My Carolina, to share about the …

We have been targeting a public release of our dynamic soybean grower decision support tool which would allow producers …

As of earlier this week, NCDA & CS Inspectors have collected 262 samples of cotton seed to be tested, …

Have you ever wondered how much rain fell during a recent thunderstorm? How about snowfall during a winter storm? If …

North Carolina farmers plant soybeans from the Mountains to the Coast. Providing soybean producers with opportunities to learn best …